Alawwal Saudi Equity Fund

It is an open-ended long-term investment fund denominated in Saudi Riyal. It commenced operations on 1/9/2009 with a capital of 5,517,734 SAR. The fund aims to achieve capital growth over the medium and long term.

Unit Price: جاري التحميل...

Date: 19-2-2026

Alawwal Periodic Income Fund

The fund aims to generate periodic cash income to be distributed to the fund’s unitholders twice a year. This represents the fund’s operating return, which is expected to reach 5% annually, through investing in shares of companies listed on the Saudi stock market that comply with Shariah Board standards.

Unit Price: جاري التحميل...

Date: 19-2-2026

Alawwal Saudi Riyal Murabaha Fund

It is an open-ended investment fund that commenced operations on 1/4/2009 with assets totaling 25,000,000 SAR. The fund provides subscribers with the opportunity to collectively participate in the net assets and returns of the fund through investing in short- to medium-term investment instruments that are low risk and highly liquid.

Unit Price: جاري التحميل...

Date: 19-2-2026

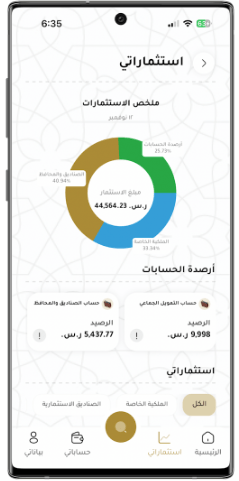

Alawwal Online App

Alawwal Capital offers innovative and successful investment products that comply with the provisions of Islamic Sharia.

- Invest with Ease

- Track Your Existing Investments

- Manage Your Portfolio

About Us

Alawwal Capital is a Saudi closed joint-stock company specialized in financial and investment services, operating within the Kingdom of Saudi Arabia with a paid-up capital of SAR 50 million. The company holds Commercial Registration No. 4030170788 dated 19/6/1428H and obtained a license from the Capital Market Authority under License No. 30-06022 issued on 5/7/2006 to conduct arranging and advisory activities, which commenced on 17/9/2007. On 30/1/2008, the activities of management and custody were added to its licenses under License No. 36-08095, and the company began practicing these activities on 16/8/2008.

Products and Services

Investment funds are among the most important investment products we offer to our clients to help them invest their savings. These products vary and include, but are not limited to, growth funds, income funds, balanced funds, and sector funds, among others.

Investment Products

Investment funds are among the most important investment products we offer our clients to help them grow their savings.

Investment Portfolios

Alawwalcapital provides tailored investment portfolio services to its individual clients

Custody Service

It is a service for managing wealth asset records.

Corporate Services

The advisory services we provide to our clients are based on well-researched scientific foundations

Latest News

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

أبرز المستجدات اليومية من عناوين الاخبار…

Faqs

Al Oula Capital provides corporate financing arrangement services, including debt structuring, Sharia-compliant financing, and mergers and acquisitions deals, all tailored to meet the needs of each client.

Al Oula Capital provides corporate financing arrangement services, including debt structuring, Sharia-compliant financing, and mergers and acquisitions deals, all tailored to meet the needs of each client.

These are a set of professional services offered by Al Oula Capital to support companies in making sound strategic, financial, and organizational decisions, improving their overall performance, and achieving their long-term goals.

Financial advisory is a specialized service provided to individuals or companies to help them with financial planning, asset management, investment, managing financial risks, and achieving their short- and long-term financial goals.

Startups that need guidance in their early stages.

Medium-sized companies looking to expand.

Large companies facing complex challenges or strategic transformations.

Helping companies choose the optimal capital structure through equity financing or Sharia-compliant debt instruments (Murabaha, Mudarabah, Musharakah).

Supporting private placements and syndicated loan operations.

Arranging and issuing Islamic Sukuk for institutions and governments.

These are a set of professional services offered by Al Oula Capital to support companies in making sound strategic, financial, and organizational decisions, improving their overall performance, and achieving their long-term goals.

These are specialized services provided to help individuals manage their income, expenses, savings, investments, and overall financial planning, aiming to improve their financial situation and achieve their short- and long-term goals.

Budget management

Retirement planning

Investment management

Tax planning

Insurance

Estate and inheritance planning

Risk assessment

Financial advisory is a specialized service provided to individuals or companies to help them with financial planning, asset management, investment, managing financial risks, and achieving their short- and long-term financial goals.

Financial consulting is a specialized service offered to individuals or companies to assist them in financial planning, asset management, investment, handling financial risks, and achieving their short- and long-term financial objectives.